Collections

The Float Service implements a sophisticated collection engine designed to optimize repayment rates while maintaining regulatory compliance.

Diagram source code: docs/modules/ROOT/images/diagrams/processes.py.

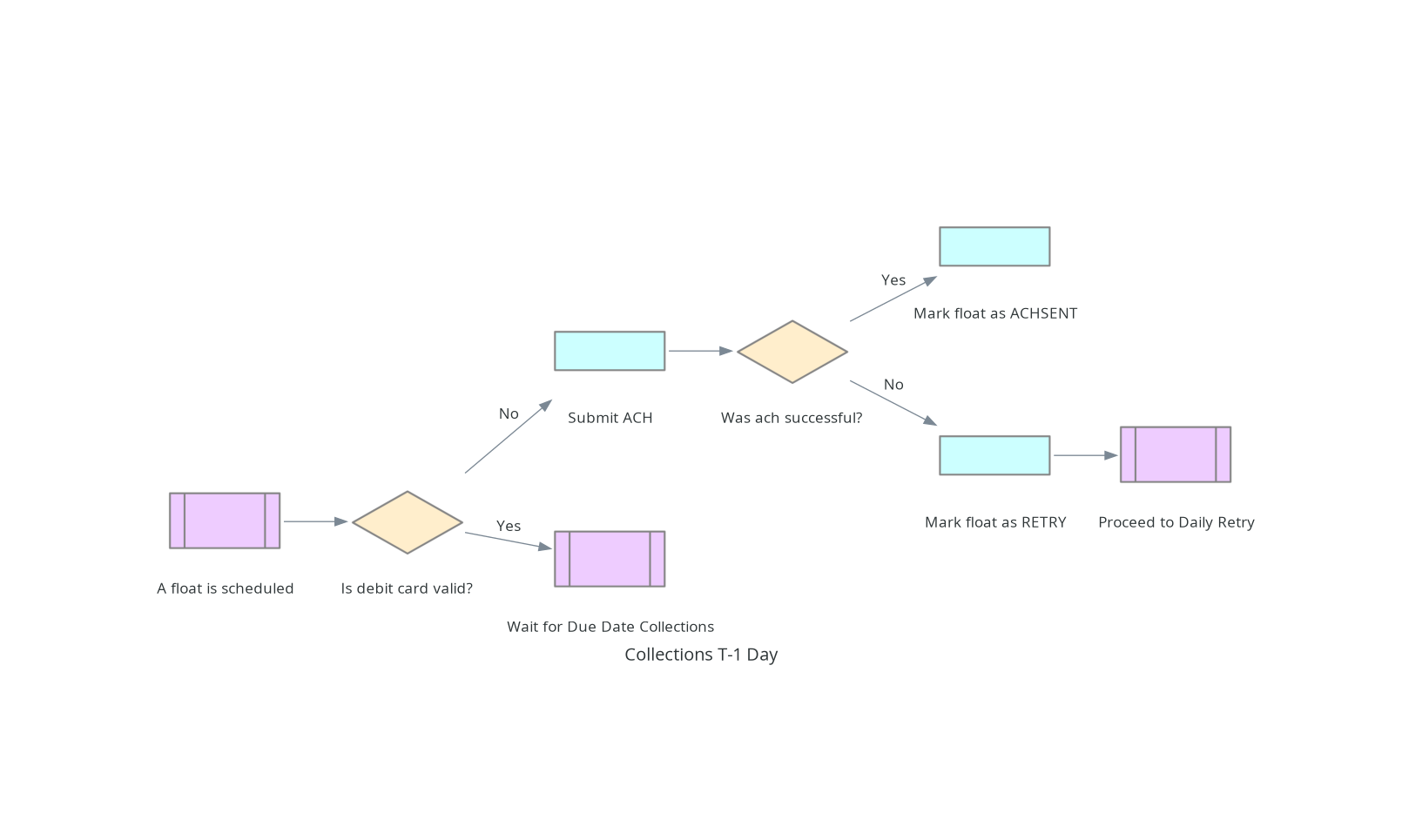

Scheduled Collections

Scheduled collections follow a multi-stage attempt strategy based on the float’s due date.

1. T-1 Day (6AM)

The day before the float is due, the system checks if the user has a valid debit card on file. * Invalid Card: The system immediately submits an ACH debit attempt. * Valid Card: No action is taken at this stage, waiting for the due date to attempt a pinless debit.

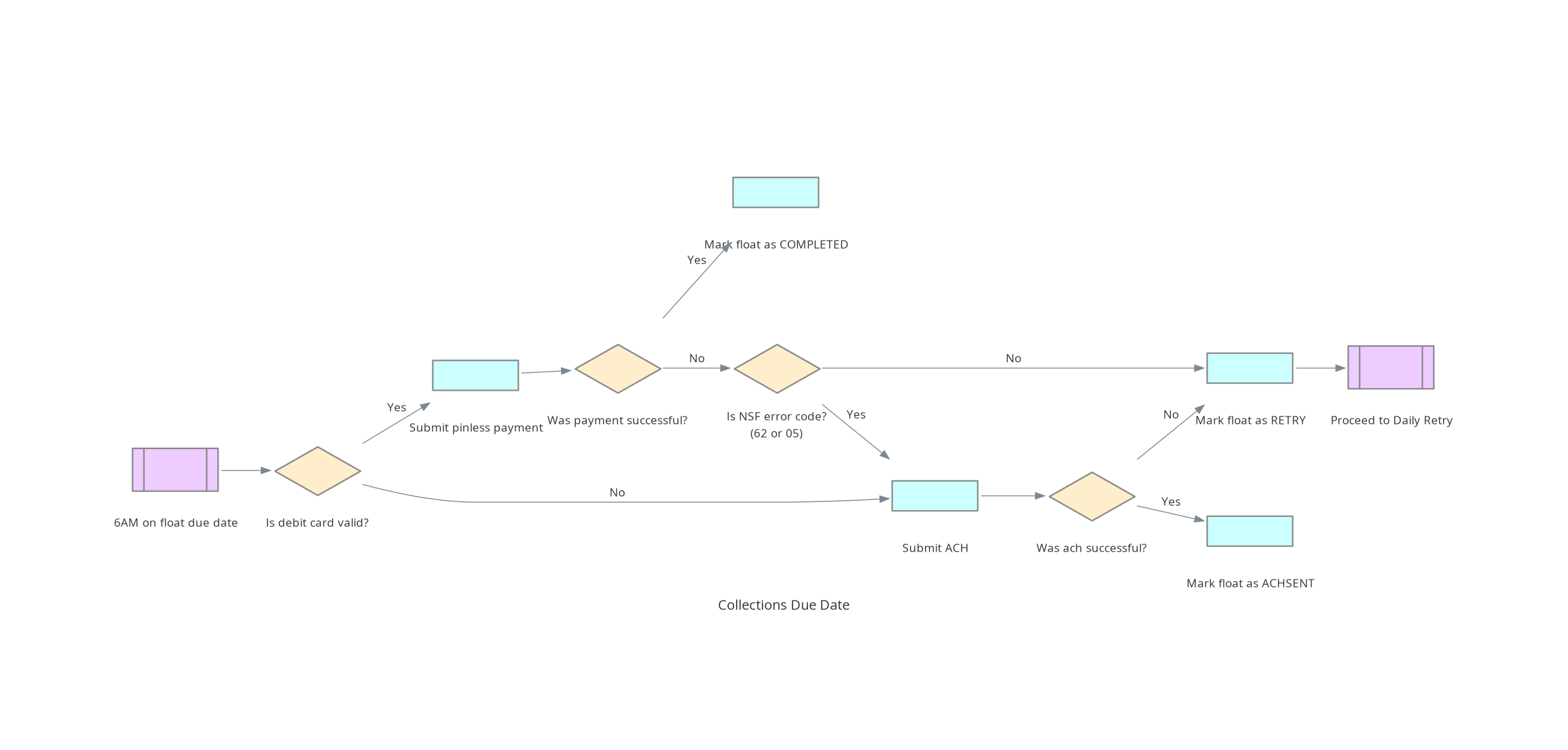

2. Due Date (6AM)

On the actual due date, the system attempts to collect the funds.

* Pinless Debit: If a valid debit card exists, a pinless debit is submitted. This is the preferred method as it is instantaneous.

* ACH Fallback: If the pinless debit fails with specific NSF (Non-Sufficient Funds) error codes (e.g., USIO 62 or 05), the system automatically falls back to an ACH attempt.

* Retry State: If all attempts fail, the float is marked as RETRY.

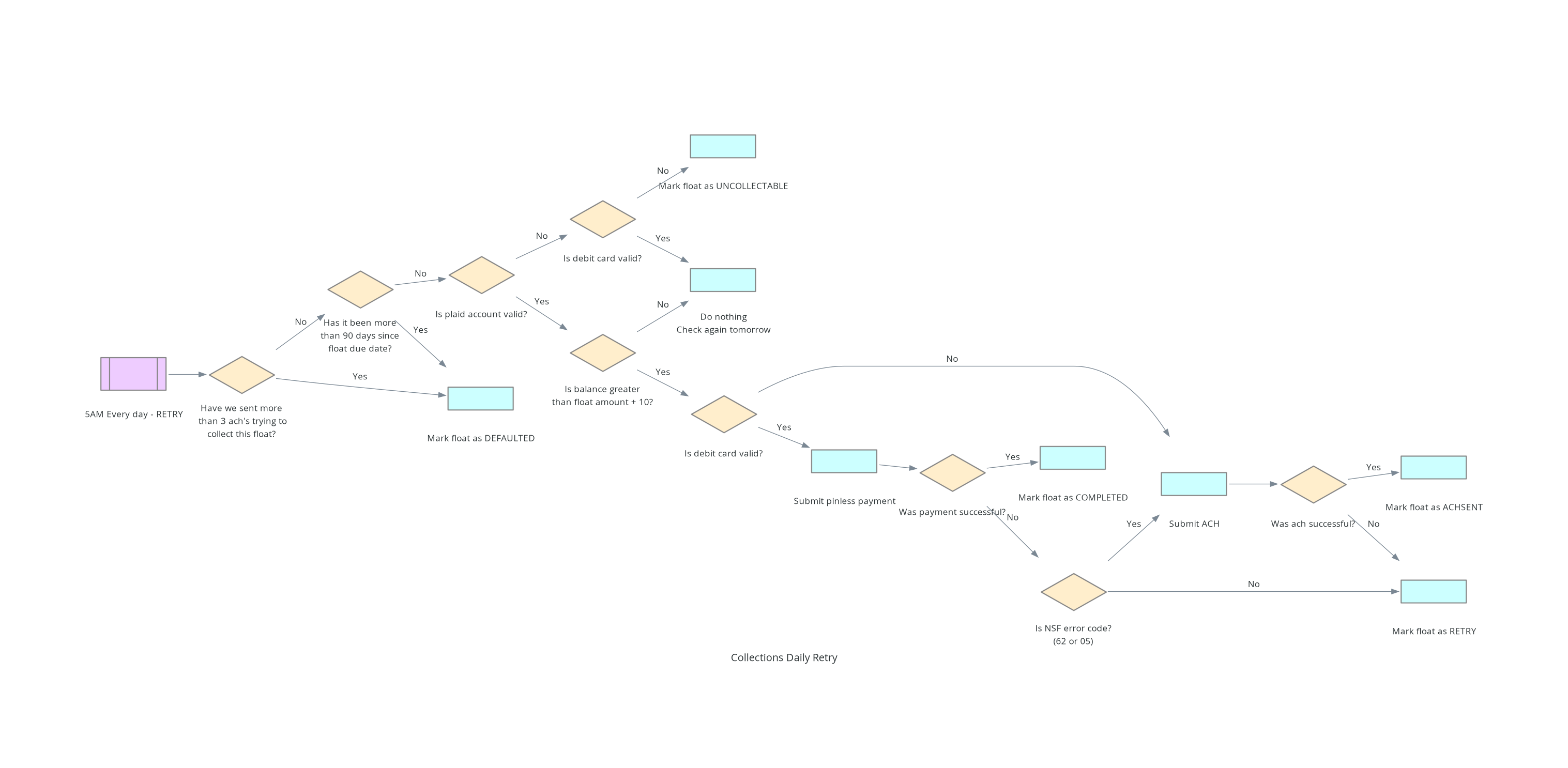

3. Daily Retry (5AM)

Every morning at 5AM, the system attempts to collect floats in the RETRY state.

-

Limits: The system stops automated attempts after 3 unsuccessful ACH attempts.

-

Defaulting: Floats reaching 90 days past due are marked as

DEFAULTED. -

Balance Checking: Before attempting a retry, the system verifies if the user’s bank balance is sufficient (Float Amount + $10 buffer) to avoid causing overdrafts.

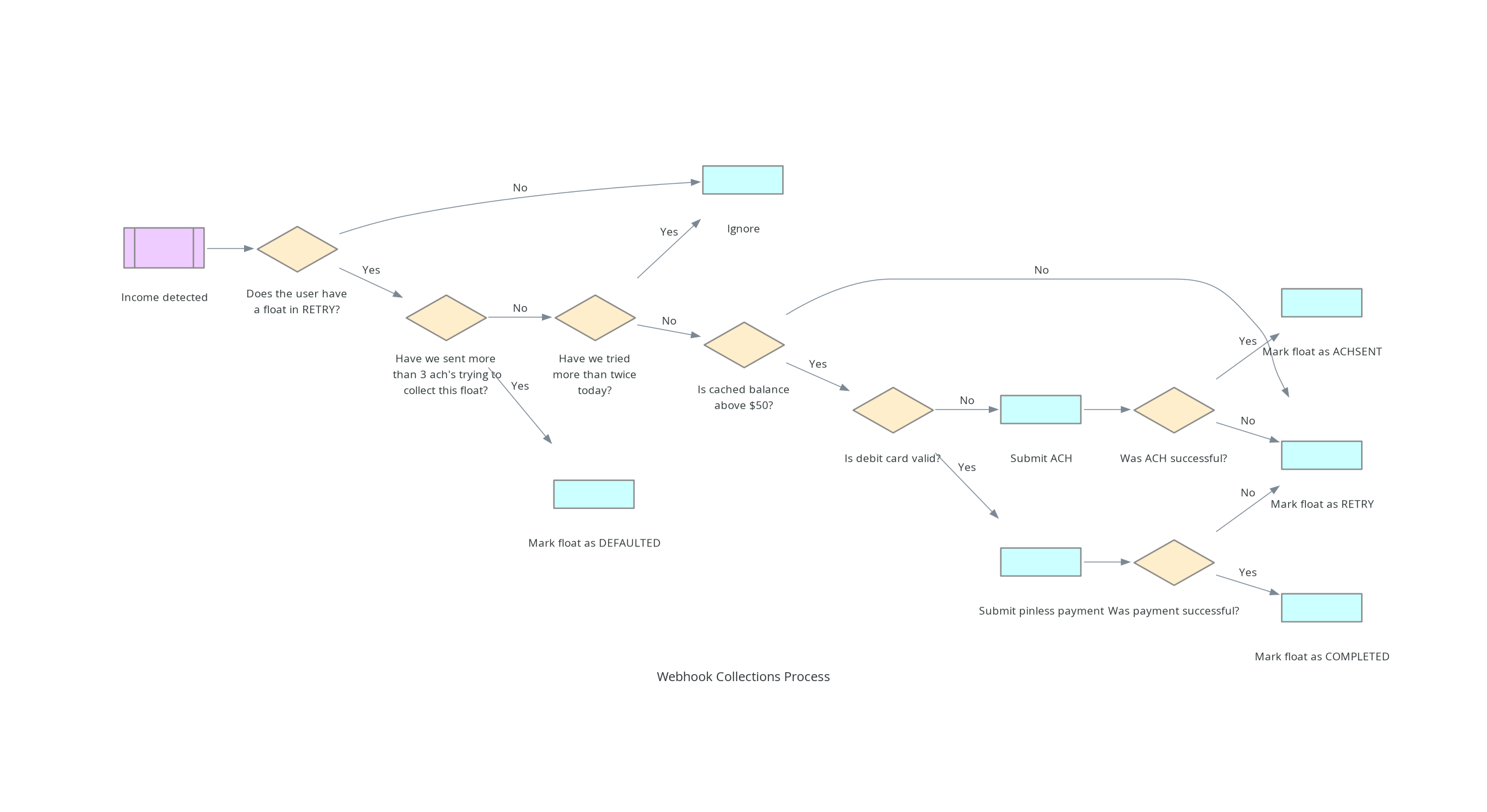

Webhook Collections

Webhook collections are driven by real-time income detection events.

-

Income Detection: When a deposit is detected in a user’s linked bank account, the

webhook-workeris notified. -

Eligibility Check: The system checks if the user has a float in

RETRYstatus and ensures it hasn’t already attempted a collection more than twice that day. -

Smart Collection: If balance criteria are met, it attempts a pinless debit (preferred) or ACH repayment.